Laffer curve and 50p

Recently there's been talk of the 50% income tax rate in Britain. The 50% (or 50p in a pound) rate is to be introduced for anyone earning over 150,000 in Britain, of which there are about 300,000 people. Estimates are that:

the difference between the 50p tax and a 45p tax might only be 750m a year

And that introducing the 50p rate will:

At 50p, the incentive increases to retire earlier, emigrate, contribute more to a pension or invest in tax avoidance schemes

Instead of the usual rubbish trotted out by the right wing parties in the US like "trickle down" and "assisting job creators" it was the first time in a while that I'd heard the Laffer curve being used.

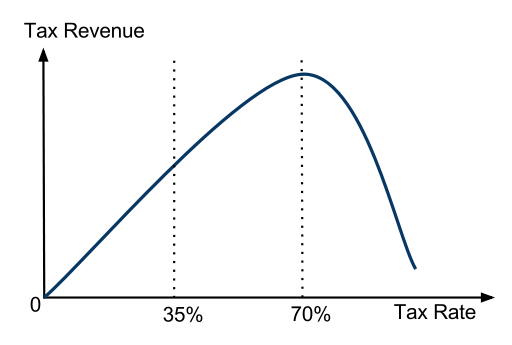

The curve is named after Arthur Laffer who popularized its use and allegedly drew it in a napkin for Dick Cheney and Donald Rumsfeld. The theory is simple. If you draw a graph of tax revenue and tax rate, you have a start and end point of 0% and 100% tax respectively. At these two end points revenue is zero (at 100% tax rate no-one would bother doing anything, so you collect no revenue).

So you end up with a graph that may look like this:

So here's the wonderful vote winning claim that politicians love. If your taxes are on the right side of the curve, by decreasing taxes, you increase revenue. Lower taxes and more spending, everybody wins. Look up the Laffer curve and you'll often see references to Reagan who embraced them.

Supply-side voodoo which claims that tax cuts pay for themselves and/or that any rise in taxes would lead to economic collapse has been a powerful force within the G.O.P. ever since Ronald Reagan embraced the concept of the Laffer curve.

This is in essence what the report from the Treasury is saying. There will be diminishing returns from the increase in tax. They are on the left hand side of the curve and each increase will bring diminishing returns as people avoid taxes.

There are more holes in the Laffer curve than there are in a teabag that's been fighting with a thistle, but that's Economics for you. The most important thing to hope is that you are in the right spot on the unknown and ever changing Laffer curve. Otherwise, things get expensive quickly.

Increasing the rate to 50p has much more to do with the problems brought about by the bank bailouts. A reaction to the bailout of banks which is being paid for by the lower classes, rather than the upper classes.

It's been many years since Economics 101 but seeing this article, made me think instantly of those classes.